IP DAO

-

Every project within the IP DAO is a chance for potential profit.

The IP Coin (FUll name is IP CRE8 Token) is the smart contract needed within the IP DAO environment. The coin is a direct appreciation of the perceived value of the patent pool within the DAO rendering it effectively the legal tender inside this ecosystem.

-

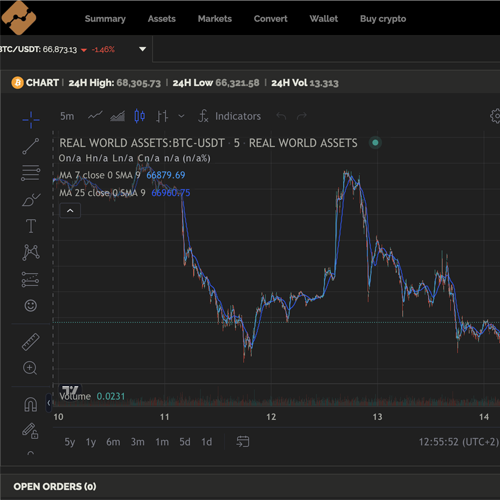

As one of many concurrent projects, the IPDAO owns it's own crypto exchange; on that exchange you can find the IP (CRE8) token.

On this exchange you will find An assortment of our projects, as well as a variety of common trading pairs such as ethereum and bitcoin.

The RWA Exchange has some of the cheapest trading fees out there, as making money being an exchange is not the main goal!

This exchange can be found at: Signup to Real World Assets

Signup to Real World Assets

Buy IP token directly

Buy IP token directly

Buy IP token directly

You can buy sell and trade IPCRE8 on our platform or simply trade them in:

metamask

buy & trade on uniswap

The current otc trading price can be viewed in the tradingview widget Here

-

The current trading price can be viewed in the tradingview widget Here

-

This platform is for Inventors, Investors, Business Builders and world improvers alike.

The IPCRE8 token is what is known as a "Utillity token"; this means that it's token value is directly derived from the ownership of "Real World Assets" within the IPDAO.

The IPDAO (Intellectual Property Decentralized Autonomous Organization) is a democratic coop between the holders of IPCRE8 tokens.

Every holder of IP Tokens essentially is a co-owner of the IPDAO and can influence it's policies and gain from it's profits. -

The answer lies in the abbreviation: IP.

Although IPCRE8 finds it's roots in creating patents for people that, for many reasons, could otherwise not file them.

We stand for investing in mind capital in all it's shapes and forms. This could be, getting help with filing a patent, but could easily mean creating a product, or help from an engineer or scientist.As said earlier we are A DAO that derives it's power from cooperating with eachother, you never know which qualities our members could have.

Q & A

-

All you need is an idea you want to patent, or qualities that can help someone to build out their ideas into a Business!

Or if you are not a creator; Invest in someones promising project and enjoy the profits. -

One of the features of IPDAO is that we invest in Mind Capital!

Filing a patent can be very expensive, more than 50K is no exception.

Your ideas can be worth plenty, all that is needed from you is to write them down, and we file a patent for you at no cost, but a shared risk.

This patent (when and if granted) will remain 90% yours. The 10% is held in escrow to make the DAO work.

As other IPCRE8 members do the same; you now own 10% of theirs just as they own 10% of yours. -

You do not; building companies come in different forms. You need an idea, sure! but there are plenty inventors here already. simply connecting yourself to one of them, will allow you to sell their ideas and products, and receive shared profits from them.

-

No it is not.

The NFT's represent legal ownership, just like ownership shares they hold a novel legal contract linking them. this contract is unique to every specific IPCRE8 project.The concept of an NFT was used to define unique ownership, and link that ownership to a specific wallet, that when a sale or revenue share occurs to that specific project within the IPDAO, the owner can be rewarded.

-

Obviously they can be sold within our own marketplace on: ipcre8.com, but just like any other NFT these smart contracts can be sold anywhere; there are many NFT markets to sell them on, like eg. opensea.io

-

IP CRE8 liquidity pool paper

the IP CRE8 liquidity pool is a smart contract that locks tokens to ensure liquidity for patent projects on a decentralized exchange. Users who provide tokens to the smart contract are called liquidity providers. DeFi liquidity pools emerged as an innovative and automated way of solving the liquidity challenge on decentralized exchanges. They replace the traditional order book model used by centralized crypto exchanges, which was lifted directly from the established financial markets. In this model, we have adapted this concept to accommodate the IP CRE8 model. the exchange serves as a marketplace where inventors and investors (token buyers/ holders) come together and agree on prices for assets based on the relative supply and demand of patents and ideas. However, this model depends on there being enough buyers and sellers to create liquidity for a proposed project. Therefore, the market makers is always someone to meet the demand, effectively creating opportunity to inventors in creation of their ideas/ patents, and evolving in to a marketable product and/or service, by contributing liquidity.

what is the CRE8 IP liquidity pool?

the IP CRE8 liquidity pool is a smart contract that locks tokens to ensure liquidity for patent projects on a decentralized exchange. Users who provide tokens to the smart contract are called liquidity providers. DeFi liquidity pools emerged as an innovative and automated way of solving the liquidity challenge on decentralized exchanges. They replace the traditional order book model used by centralized crypto exchanges, which was lifted directly from the established financial markets. In this model, we have adapted this concept to accommodate the CRE8 IP model. the exchange serves as a marketplace where inventors and investors (token buyers/ holders) come together and agree on prices for assets based on the relative supply and demand of patents and ideas. However, this model depends on there being enough buyers and sellers to create liquidity for a proposed project. Therefore, the market makers' role exists to ensure that there is always someone to meet the demand, effectively creating opportunity to inventors in creation of their ideas/ patents, and evolving in to a marketable product and/or service, by contributing liquidity.The simplest version of a DeFi liquidity pool holds two tokens in a smart contract to form a trading pair. CRE8 IP connects the generated patent NFT to CRE8 IP tokens inserted into a liquidity pool Within CRE8 IP We have adapted that to pair eg. a patent to a required number of tokens, thus claiming direct part ownership of it's revenue stream. albeit in refining an idea into a patent, or to refine/combine patents to become a more profitable/better one. Or even to setup a company around a patent and exploit it like a business for a buildable product or service. Other than buying generic tokens, which will fluctuate in value based on generic market workings, a liquidity pool creates an opportunity to create separate gains aside form the generic market workings.

A pool consists of the creation of "a company like structure of sorts" represented in a NFT contract, directly connected staked CRE8 IP tokens, making it possible for a single idea/patent to be developed to become more mature or actually materialised into a marketable product. This allows LP. contributors to directly gain profits from possible license fees or market sale of the eventually finished asset. In order to create a business like structure normally an participation is needed, to then create a company around an idea/patent, involving a lot of paperwork and structure, which then in turn tries to either create a product or service, or to debug2: channel 0: window 988933 sent adjust 59643 protect it's value through licensing to parties that make use of said idea/patent.The liquidity pool takes care of all the components needed that can be automated in this process. It registers who are the investors and who holds the idea/patent in it's blockchain. At the same time it takes care of the legal element such as llc limited company creation, making it a legit separate business while still within the token blockchain. In this example we will use an investor buying tokens on one side, and an inventor with a project/patent on the other. Let's say a buyer has purchased 10 tokens, if he chooses he can just wait for the token appreciate over time. However he can also invest his coin into a liquid pool inside of the token realm. If he chooses to enter his tokens into a LP. the tokens are then locked for a defined period of time which comes with a payment of an initial fee paid for in ethereum.

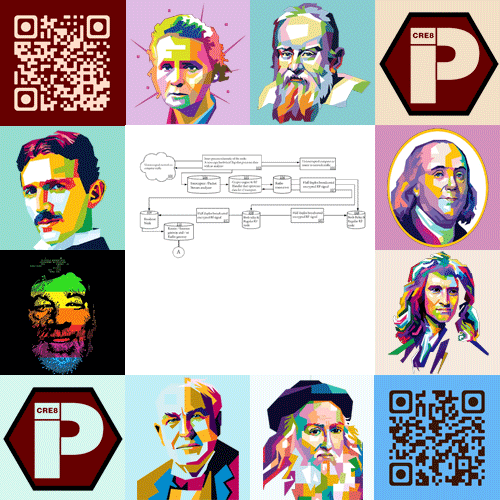

Below you can see a flow depiction of a patent that is inserted into the system up to a description of our liquidpool functionality

Liquidity providers are incentivized for their contribution with rewards. When they make a deposit, they receive a new token representing their stake, called a pool token. In this example, the pool token would be LP-IP CRE8. The share of trading fees paid by users who are in the pool are distributed automatically to all liquidity providers proportionate to their stake size. To create the llc and handle keep and registration costs are made. So if the fees for the LP-IP CRE8 pool are 0.3% and a liquidity provider has contributed 10% of the pool, they're entitled to 10% of the total added value of the project minus 0.3%. When a user wants to withdraw their stake in the liquidity pool, they burn their pool tokens and can withdraw their stake, but they can only do so after the set time limit has passed whereafter the gains swell as their initial staked tokens are released back to them.

What are the risks of DeFi liquidity pools?

The algorithm that determines the price of an asset may fail, slippage due to large orders, smart contract failure and more. The price of assets in a liquidity pool is set by a pricing algorithm that continually adjusts based on the pool's trading/building activity. If an asset's price varies from the global market price, arbitrage traders that take advantage of price differences across platforms will move to profit from the variance. In the event of price fluctuations, liquidity providers can incur a loss in the value of their deposits, known as impermanent loss. However, once a provider withdraws their deposit, the loss becomes permanent. Depending on the size of the fluctuation and the length of time the liquidity provider has staked their deposit, it may be possible to offset some or all of this loss with transaction fee rewards. DeFi users face other risks, such as smart contract failure, if the underlying code isn't audited or fully secure. Make sure to understand all the risks before depositing any funds.

What are the benefits of the CRE8 IP liquidity pools?

The most obvious benefit of the CRE8 IP liquidity pools is that they ensure a near- continuous supply of liquidity income for staking token holders. They also offer the opportunity to profit from future gains from holding CRE8 IP tokens, and initial ethereum gains and fees when staking has ended. Furthermore, many projects and protocols will offer additional incentives to liquidity providers as projects can split into new ones, to ensure that their token pools remain large, reducing the risk of slippage and creating a better trading experience.

How can I join DeFi liquidity pools?

Here you will find an api that allows you to connect to your existing wallet (like metamask). it will show how to select and connect your CRE8 IP tokens to the project of your choice (to connect to a specific project), and become part of that LP. In the flowchart below you can follow a step by step chain of events; from when a patent is added to CRE8 IP to the eventual liquid pooling of the asset.

-

TOKENIZED PATENT MARKETPLACE

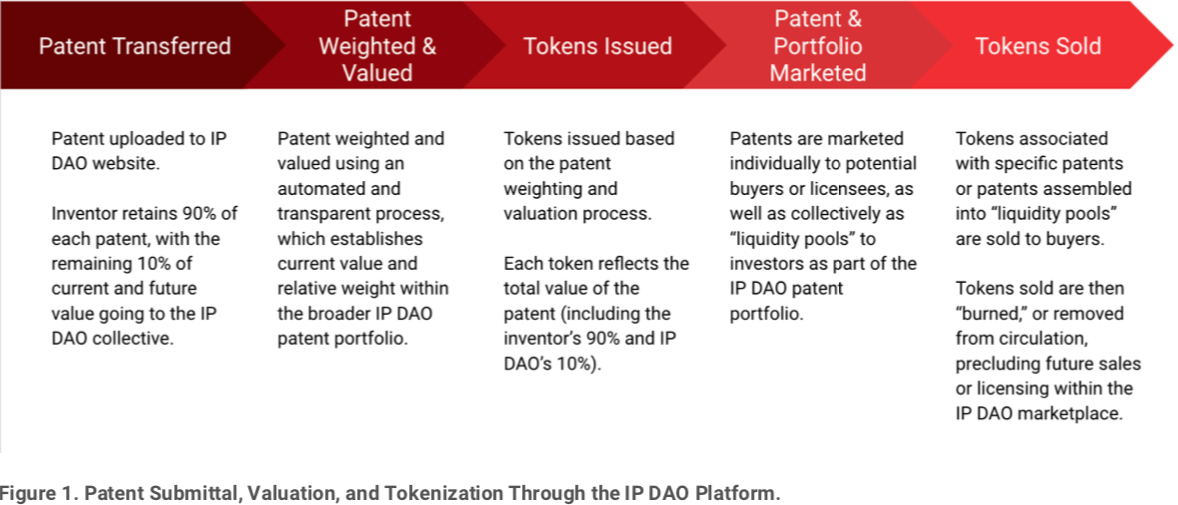

The following section outlines the process that innovations undergo as they transition from ideas to granted patents and eventually tokens reflecting the dynamic value of those patents.

PATENT SUBMITTAL

Innovators with ideas that they feel have the potential to be patented verify their identify with their passport and complete a form asking questions regarding the attributes and novelty of the potential invention. Responses to the patent attribute form will be encrypted and tied to the inventor's crypto wallet to ensure that no other individuals or entities have access to the information regarding the potentially patentable idea. IP DAO's novel AI-driven and big data leveraging software will translate the responses questions in the form into a draft provisional patent application. A more comprehensive discussion of the automated patent drafting software is presented in subsequent sections. A different module within the IP DAO ecosystem will then carry out an automated process to screen and pre-value potentially patentable ideas first for overlap with existing IP referred to as “prior art†and then based on evolving relationships between key patent claims and market trends. Potential patent ideas that do not exceed a projected market value of one million USD will be excluded or flagged for secondary review. Provisional patents will be filed with the USPTO to establish an inventor's right to relevant IP as of a “priority date.†Following provisional patent submittal, inventors will be able to invite potential collaborators to view their non- provisional applications to enhance their effort. Inventors may elect to use a portion of their remaining 90% equity in their potential patent to secure support from other inventors or specialists through the exchange of IP DAO coins. A visual overview of the IP DAO's patent submittal, valuation, and tokenization process is presented in Figure 1.

PATENT VALUATION, TOKENIZATION, AND TRANSFER OF COINS

Once a patent application is submitted to the IP DAO, it is assigned a weight within the current broader innovation ecosystem's patent portfolio using an automated and transparent process considering factors such as the state of innovation in that field, the estimated value of similar patents similar to those generated by PatSnap2, and other considerations. Patents with greater current financial value (e.g.; IP DAO's drone zapper patent) are assigned a greater weight within the portfolio. A patent's value and weight are then translated into IP DAO non-fungible tokens (NFTs) and IP DAO coins are issue consistent with the total current estimated value of the patent. Inventors receive 90% of the coins and the IP DAO, collectively owned by all inventors and investors participating, receives the remaining 10%. IP DAO coins can then be held by inventors or investors as they track the value of the IP DAO innovation ecosystem's portfolio. Tokens will be periodically re-valued and re-weighted using the automated process to ensure that patent values are reflected.

(PatSnap offers an array of services to innovators including an estimation of granted patent values using a complex and somewhat opaque process. Additional information regarding PatSnap can be found at https://www.patsnap.com/)

IP DAO LIQUIDITY POOLS

Inventors or investors owning the rights to IP may elect to bundle or group individual patents together to yield attractive participation opportunities. These bundled or grouped patents are locked into “liquidity pools†or LPs via a smart contract for a set and clearly conveyed period of time. The conditions for participating in a given liquidity pool are transparent and self-executing once relevant coins are purchased or placed in the pool. Individuals or entities invest in a given bundle of IP for a set period of time and are entitled to a proportional change in the value of the patents in the LP. A theoretical participation in a bundle of cryptographic patents placed into an LP that experiences in tenfold increase in value during a 24 months period would increase the participation by a factor of ten.

PATENT SALE OR LICENSE THROUGH COINS

Patents included within the IP DAO innovation ecosystem are marketed individually to potential buyers or licensees, and collectively to investors in LPs assembled to achieve a development goal or align with anticipated investor interest. Web-based patent search engines direct interested parties to intermediates website and eventually to the IP DAO innovation ecosystem's landing page. Potential buyers and licensees are able to identify patents of interest, see the most recent valuation, and submit an offer at or above the current valuation for a single patent or an LP. Offers to purchase or license a patent or LP will go to all entities holding tokens associated with that patent or LPs and will be approved if 70% or greater of the token holders agrees to the value of the offer. Terms or conditions of the sale are inherently built into relevant tokens and the transaction can be completed immediately once payment in an accepted currency is received. Entities that have purchased tokens associated with a specific patent will be able to keep them to re-sell at a later date or can elect to burn them and remove them from circulation, effectively precluding any future sale of the patent within the broader IP DAO platform.

STREAMLINED PATENT SALE AND LICENSING

This process within the IP DAO's innovation ecosystem is significantly more efficient and streamlined than the traditional approach to identifying and purchasing or licensing a patent. Once a prospective patent buyer identifies a patent of interest, legal support is retained and employed to reach out to the legal firm representing the current patent holder(s) and initiate a negotiation regarding patent sale price and other conditions. Highly sought-after patent lawyers often require a retainer of $15,000 - $30,000 to initiate work on behalf of a patent buyer, a significant financial barrier often barring a large portion of prospective buyers from entering the patent purchasing marketplace.

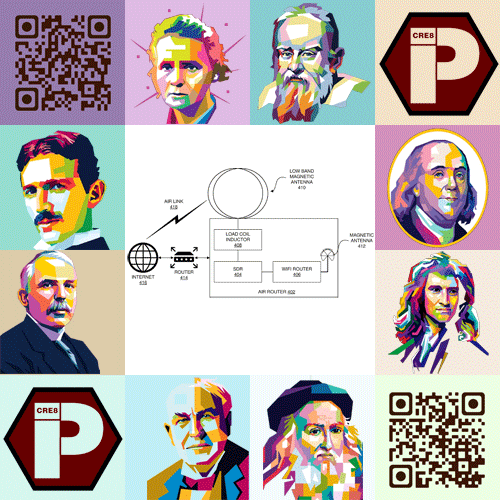

An agreement is typically eventually reached and drafted with legal support on both the patent seller and buyer billing market rates of $500 - $1,500 per hour before both sides sign the deal and patent ownership is transferred. This process can be quite quick and efficient in some cases but often requires extensive time and financial resources on both the patent seller and buyer sides with legal fees constituting up to 30% of the value of the patent transferred in some cases. Groups or portfolios of patents analogous to LPs are often not available for purchase unless IP holders are distressed financially. All of these inefficiencies that divert resources to costly legal support are avoided through the use of the IP DAO coins that inherently and explicitly reflect the current value of the patent and the terms of the sale. A visual overview of patent buyer or licensee benefits derived from the IP DAO are presented in Figure 2.

A foundational element of the IP DAO's innovation ecosystem is an artificial intelligence (AI) driven language processing module employing big data approaches translate a series of inventor responses to an initial questionnaire into a patent application. This novel approach uses emerging computational resources and linguistic theory to review existing publicly available patents to isolate patterns surrounding terminology, sentence construction, and organizational structure to produce a comprehensive and robust patent application without any human involvement and therefore risk to the inventor. An inventor's questionnaire responses and interactions with the IP DAO platform are tied to their Metamask crypto currency wallet and are therefore secure and isolated from other members of the innovation community. Each inventor may be prompted to make revisions to responses to a given question and iterate through an automated refinement process until a provisional patent application meets IP DAO standards regarding content, novelty, and completeness. Inventors can invite other members of the IP DAO collective to view and support their patent application effort by providing them with unique keys following the filing of a provisional patent with the USPTO, a process that affords the inventor a measure of protection with a priority or first to file date.

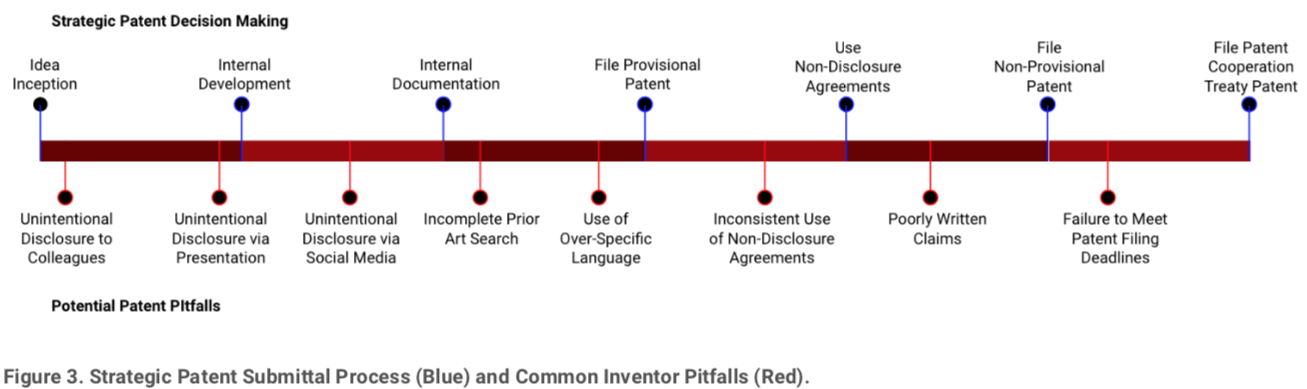

In addition to the first of its kind automated patent generation functionality of the platform, the IP DAO offers an extensive array of resources and guidance to ensure that prospective inventors are able to establish a comprehensive and strategic plan to protect their ideas prior to provisional patent submittal and maintain that protection through additional fillings. The patent application process is complex and often overwhelming, both financially and with respect to the multiple-year process, for inventors who have emerged as thought leaders in their respective fields. Inventors are typically responsible for legal fees incurred during patent application development and consultation on the order of $35,000, a financial barrier that often keeps inventors from protecting their ideas. The IP DAO removes this financial barrier and asks for 10% ownership of the patent, once granted, in exchange for access to resources. The platform and the innovation ecosystem surrounding it offer inventors access to resources to ensure that unintentional disclosures, often made through conference presentations or social media posts, are avoided and provisional patent applications are filed to maintain protection and the potential for successful subsequent national and international non-provisional patent application. A visual summary of strategic patent pursuit laid out in IP DAO resources and pitfalls to avoid is presented in Figure 3.

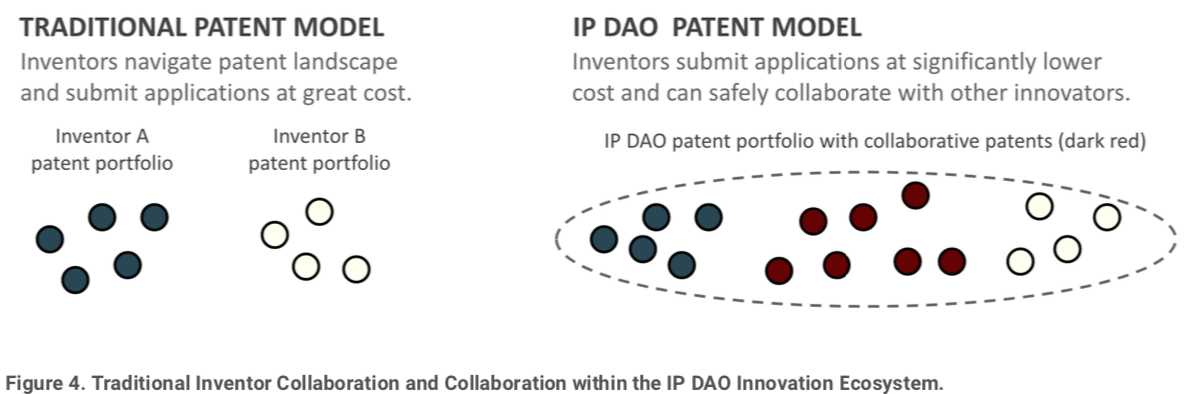

By removing the financial barriers to filing patents and offering resources that empower inventors to make strategic decisions during the process, the IP DAO and the innovation ecosystem it created offers a new means of protecting innovation. Inventors with promising ideas who do not have access to tens of thousands of dollars to cover legal fees are offered a path toward patent submittal and ownership. Innovators who would otherwise work to secure the funds to pursue the traditional route of finding a patent lawyer, typically involving the payment of a large retainer and close to $500/hour for legal support, will be in a position to use those funds to pursue additional projects and innovation. The end result is expected to be more patents filed through in the IP DAO innovation ecosystem.

PROTECTED INVENTOR COLLABORATION

A key and innovative element of the IP DAO innovation ecosystem is the development and implementation of a platform that allows for innovators to safely interact and collaborate without fear of losing the rights to and future value of their ideas. This collaboration is enabled through the documentation of novel ideas through a block-chain hyper contract where the contributions of novel ideas that then go on to be patented are documented in a legally comprehensive ledger.

Traditionally, innovators who have gone through the patent application process become averse to sharing ideas with others without some form of protection such as a non-disclosure agreement as they have seen inventors lose control of the use and value of their ideas. While experienced inventors are often sufficiently savvy to avoid unintentionally disclosing ideas into the public domain, the potential for an early collaborator running away with an idea at a nascent stage typically smothers the prospects of open collaboration and the exploration of potential synergies between ideas.

The IP DAO's legally comprehensive ledger is tied to an ecosystem for innovators where the open discussion of a novel idea and the individual making that contribution is documented at its inception. The evolution of a given idea through refinement, revision, or combination with ideas generated by other innovators is all documented in a clear and transparent manner in the blockchain hyper contract among IP DAO innovators. Any innovator, at any point in time, is able to look at the blockchain ledger showing the history of contributions made toward a patent and the individual responsible for those contributions. This blockchain ledger is updated and distributed across the computer systems of all IP DAO participants so that hundreds of versions of the same information are present on an extensive array of different devices.

This distribution of the ledger documenting transactions is consistent with how a rapidly growing number of blockchain enabled elements in society are developed to yield additional security in transactions as changing, cheating, or alteration of the ledger would require the revision of all versions of the ledger on all devices.

This platform for innovators to interact and collaborate is expected to yield additional patents as individual ideas are combined and opportunities for synergy are identified. A visual representation of inventor collaboration through the IP DAO innovation ecosystem is presented in Figure 4. This potential for collaboration has already yielded a number of patents as IP DAO inventors were able to combine complementary ideas and submit additional patent applications. Furthermore, inventors holding patents outside of the IP DAO innovation ecosystem may elect to bring their granted patents into the collaborative framework with the understanding that there may be unrealized opportunities to leverage existing portfolios, identify synergies, and expand that value by filing additional patents.

Have Question ? Get in touch!

We are a huge marketplace dedicated to connecting great artists of all IPCRE8 with their fans and unique token collectors!

Contact us